Over that time, the company has reduced its net working capital cycle-the amount of time it takes to turn assets and liabilities into cash-by 23 days and unlocked $1.4 billion in cash.

The global aluminum company Alcoa made working capital a priority in 2009 in response to the financial crisis and global economic downturn, and it recently celebrated its 17th straight quarter of year-on-year reduction in net working capital. And the rewards for persistence and dedication to continuous improvement can be lucrative. We routinely see companies generate tens or even hundreds of millions of dollars of cash impact within 60 to 90 days, without increasing sales or cutting costs.

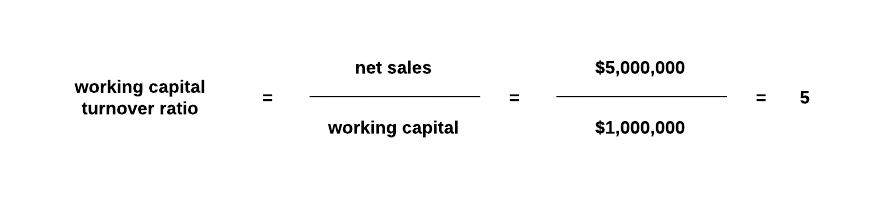

#Operational working capital turnover free#

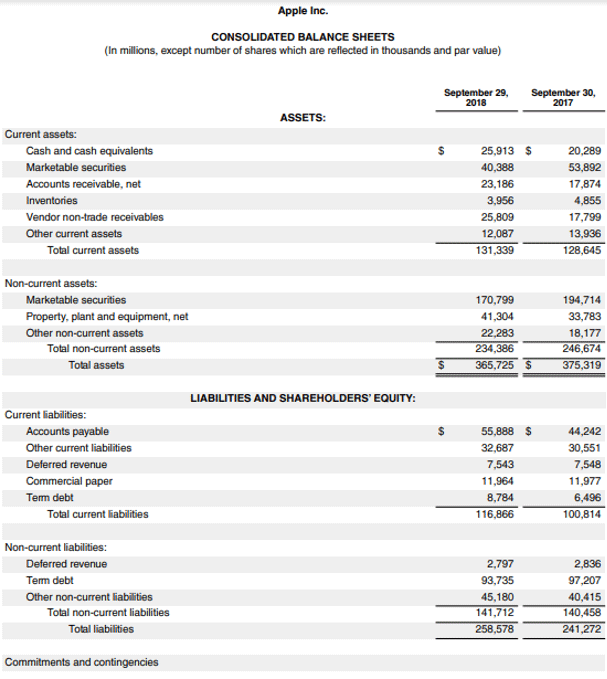

Improving its management can be a quick way to free up cash. Working capital can amount to as much as several months’ worth of revenues, which isn’t trivial. That’s quite a missed opportunity-and it has implications beyond the finance department. Although working capital management has long been a business-school staple, our research shows that performance is surprisingly variable, even among companies in the same industry (exhibit). And because working capital doesn’t appear on the income statement, it doesn’t directly affect earnings or operating profit-the measures that most commonly influence compensation.

It’s hard to know how well a company is doing, even relative to peers published financial data are too high level for precise benchmarking. Defined as the cash companies have tied up between what they’ve purchased (inventory and accounts payable) and what they’ve sold (accounts receivable).

Managing a company’s working capital 1 1.

0 kommentar(er)

0 kommentar(er)